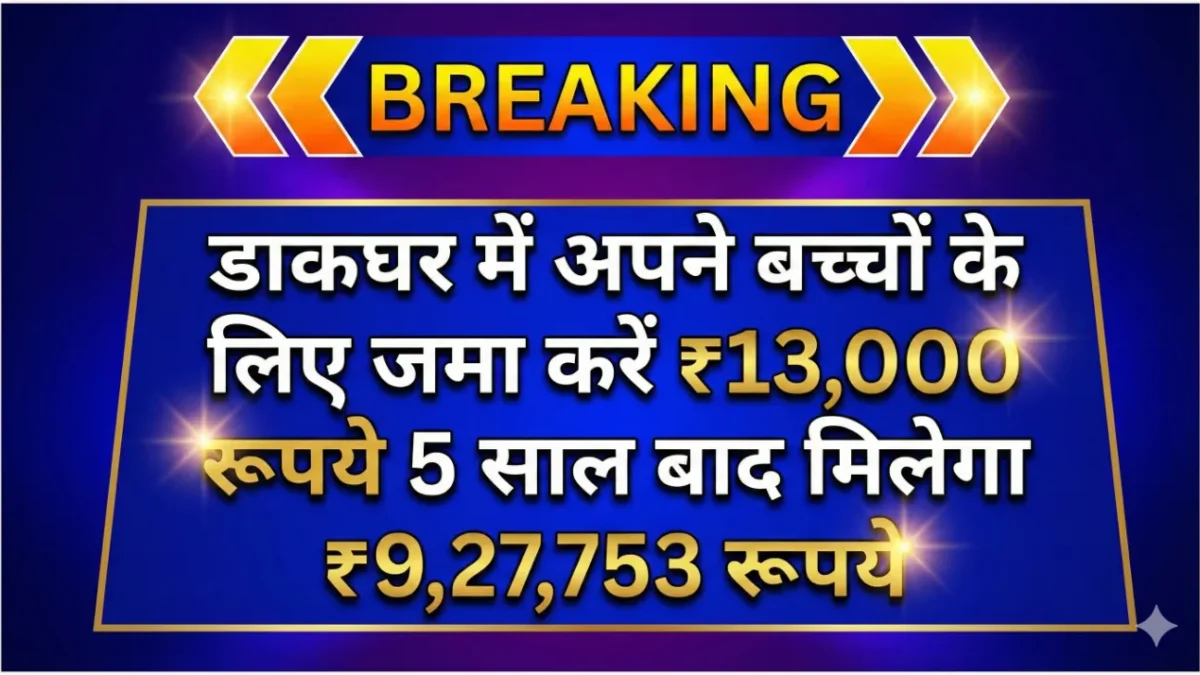

Post Office RD Scheme: Currently, many people are looking for a savings scheme where they can invest a fixed amount monthly, ensure the safety of their money, and build a substantial fund after a few years. Especially for salaried employees and small business owners who want to save a portion of their income regularly, the Post Office RD scheme presents a reliable option. There is no fear of stock market volatility or the risk of capital loss. If someone invests ₹13,000 per month in a Post Office RD, how much will they receive after five years, and how does this entire scheme work? Detailed information is presented here in simple language.

How the Post Office RD Scheme Works

The fixed tenure of a Post Office Recurring Deposit (RD) is 5 years, or 60 months. Currently, the Post Office RD offers an annual interest rate of approximately 6.7%, which is compounded quarterly. This means that each installment deposited earns interest for a different period. The initial investment earns interest for a longer period, while later investments earn interest for a comparatively shorter period. However, all installments together build a strong fund after 5 years. Since this scheme is completely government-backed, the safety of the invested money is fully guaranteed.

Total Deposit Amount with ₹13,000 Monthly Investment

If you invest ₹13,000 per month in a Post Office RD, your total invested amount after 5 years will be ₹7,80,000. This is the principal amount that you have invested through systematic savings. The real benefit begins here, as quarterly compounding interest is applied to this amount, and the fund starts growing rapidly.

Calculation of the Maturity Amount of ₹9,27,753

Now, we present the calculation that every investor wants to know. If a Recurring Deposit (RD) of ₹13,000 is maintained for 60 months at an annual interest rate of 6.7%, the total amount at maturity reaches approximately ₹9,27,753. This means your total invested amount is ₹7.8 lakh, but due to the accrued interest, you receive an additional ₹1,47,753. This entire benefit comes from the power of compound interest, making RD a powerful tool for wealth creation compared to regular savings.

Suitability of a ₹13,000 RD

This investment is ideal for individuals with a stable income who can comfortably set aside a fixed amount each month. Salaried employees, small business owners, and families planning for significant future expenses will find this scheme highly beneficial. It involves neither high risk nor complexity; simply investing a fixed monthly amount allows the fund to grow automatically over time.

Using the Fund After 5 Years

The fund of approximately ₹9.28 lakh received after 5 years can be extremely useful for children’s education, home improvements, a down payment on a new vehicle, business expansion, or any emergency needs. Many people also reinvest this amount in other secure schemes to further increase their wealth. This is the main advantage of a Post Office RD – it prepares you for the future without any risk.

Consequences of Premature RD Closure

If, for any reason, it becomes necessary to close the RD before maturity, the Post Office allows it, but the interest rate may be reduced in such cases. Therefore, it is best to let the RD run for the full 5 years to reap the full benefits of compound interest and allow the fund to reach its full potential.

Disclaimer

Disclaimer: This article is for general information purposes only. The interest rate for Post Office RDs may change from time to time. Before investing, please check the latest interest rates and rules at your nearest Post Office. This is not financial advice.

Frequently Asked Questions

Question: What is the current interest rate for Post Office RDs?

Answer: Currently, Post Office RD offers an annual interest rate of approximately 6.7%, compounded quarterly.

Question: What will be the total amount received after 5 years in a ₹13,000 monthly RD?

Answer: With a monthly investment of ₹13,000, the amount received at maturity after 5 years will be approximately ₹9,27,753, while the total invested amount will be ₹7,80,000.

Question: What happens if the RD is closed prematurely?

Answer: Premature closure of the RD is allowed, but the interest rate may be lower in such cases, so it is better to continue it for the full term.

Question: Who is this scheme most suitable for?

Answer: This scheme is suitable for salaried employees, small business owners, and families with a stable income who want to save regularly.